13 Best places to Retire in USA

We made a list of few awesome States from quiet small towns to fun beach cities. I am sure you are thinking of Retirement, Small Town to live, Healthcare, Charming city near the beach, benefits for retirees, cost of living, crime rate, and Tax rates. Before you decide, imagine the life you want and check if it fits your budget. There are some best places to retire which give treats like no taxes on retiree money which is pretty good!

Also, look at the stuff like affordable living, safety, and healthcare quality. It’s like creating the perfect mix for your retirement playlist. This article is your guide just think of it as a map for your future adventure. Picture yourself happy and thriving in a place that ticks all your boxes.

Here is the list of the 13 best places to retire in your great primer in helping find where to start this next chapter in your life.

13 best places to retire in US

1. Lancaster, Pennsylvania

The significantly affordable cost of living is a primary factor that makes retiring in Lancaster a great option. It’s also conveniently situated near major cities like Philadelphia, New York, Baltimore, and others, without the usual hustle and stress. Additionally, Pennsylvania doesn’t impose taxes on retirement income, and Lancaster’s downtown art and theatre scene is certainly experiencing notable growth.

2. Pensacola, Florida

Don’t miss out on Pensacola’s sandy white beaches, which you can enjoy year-round makes it best place to retire in USA. Pensacola registers a 14% reduction in expenses compared to the national average and proves to be 17% more budget-friendly for residence compared to the average Florida city. This assumes a $72,000 annual salary. In Pensacola, food costs are noted to be less economical than the national average. Transportation expenses in Pensacola demonstrate more affordability than the national average. Housing costs in Pensacola are more budget-friendly than the national average. Health care expenses in Pensacola are also more economical than the US average. Determining the cost of relocating to Pensacola relies on various factors. Explore Holidays packages at Pensacola Beach

3. Minneapolis, Minnesota

You’ll find comfort in Minneapolis year-round, as substantial portions of the downtown area are covered, enabling you to walk around even in cold weather and snow. While this may not be the spot for warm weather enthusiasts, it possesses all the elements of a fantastic retirement town, courtesy of its activities and affordability. The only drawback is that, unfortunately, you’ll have to pay a retirement income tax.

4. Tampa, Florida

Tampa becomes another Florida recommendation worth placing at the top of your list. Whereas Tampa indicates a 10 increase in expenses compared to the national average and demonstrates a 6 higher cost for residence compared to the average Florida city. This presupposes a $72,000 annual salary and a two Bedroom Apartment in Tampa Florida. Food costs are noted to be less economical than the national average. Transportation expenses in Tampa show more affordability than the national average. Housing costs in Tampa are less budget-friendly than the national average. Health care expenses in Tampa are also more economical than the US average. Learn more about Tampa

5. Casper, Wyoming

If you’ve grown weary of the beach, you can switch things up by turning to the mountains of Wyoming. The state boasts a lenient tax structure and the most stunning landscapes around.

6. Wilmington, Delaware

Wilmington is renowned for becoming a luxurious place to retire, courtesy of its easy-going atmosphere and amenities like parks and historical sites. Delaware also lacks any state taxes, making shopping extra fun, and it also has some of the best hospitals in the country. What more could you want?

7. Naples, Florida

Do you adore high-end stores, golf, and beaches? Look no further than Naples. The beach town possesses it all, and the sunny weather affirms it’s the place to be.

8. Raleigh, North Carolina

The laid-back state of North Carolina deserves a spot on this list, especially as Raleigh maintains an above-average air quality score. Additionally, there’s plenty of greenery and fun outdoor activities, just be aware of the state’s 4.99% retirement income tax rate.

9. Augusta, Georgia

Do you prefer mild year-round temperatures? If so, Augusta is made for you. Unlike Atlanta, there’s rarely any traffic, and you’ll enjoy big city amenities in a smaller town.

10. Huntsville, Alabama

The Appalachian Mountains and plenty of state parks surround this Alabama city. Kayaking, fishing, and boating are also common activities that can make the retired life extra enjoyable.

11. Cleveland, Ohio

Housing costs are significantly lower than the national average. Cleveland presents a 1% reduction in expenses compared to the national average and illustrates a 10% higher cost for residence compared to the average city in Ohio. This assume a $72,000 annual salary and a two Bedroom Apt. In Cleveland, food costs are noted to be less economical than the national average. Transportation expenses in Cleveland show more affordability than the national average. Housing costs in Cleveland are as economical as the national average. Health care expenses in Cleveland are also more economical than the US average.

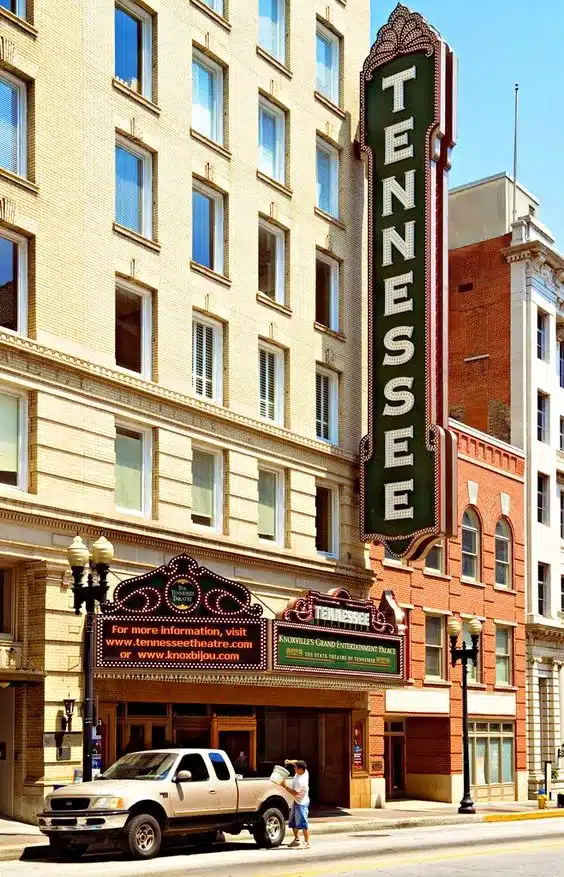

12. Knoxville, Tennessee

Another awesome place to retire, There is a very good Health and medical care services in Knoxville. People are also big fans of the Travel and sea activities. Cost of living expenses is much lower than in other cities.

13. Winston-Salem, North Carolina

Lot of young professionals and families are living in this demographic along with Retiree. Winston Salem registers an 8% reduction in expenses compared to the national average and portrays a 0% lower cost for residence compared to the average city in North Carolina. This presupposes a $72,000 annual salary. In Winston Salem, food costs are noted to be more economical than the national average. Transportation expenses in Winston Salem show more affordability than the national average. Housing costs in Winston Salem are more economical than the national average. Health care expenses in Winston Salem are less budget-friendly than the US average.